Your Weekly Market Prep (10/13)

What To Do Post-Market Crash?

Welcome back to your weekly trade plan with the Dividend Journal. If you’re new here, welcome in! The Dividend Journal’s weekly trade plan highlights all the information YOU need to be prepared for this upcoming week in the stock market.

This week’s plan in a snapshot:

Recap Friday’s market dump

Bank earnings this week

SNOW & CORZ on watch this week

Last Week Highlight

This past Friday was the worst day since April after Trump threatens a 100% increase on tariffs on Chinese imports after China declared they would restrict exports on rare earths. The Nasdaq saw a decline of 3.6% and the S&P 500 declined by 2.7%. Increasing tension between the US and China creates uncertainty for the future, but this negative headline gave investors a reason to sell. Many market participants were likely up a lot and were just holding profits until the first headline that wasn’t positive.

The politicking around rare earth elements are also very delicate as China produces around 90% of the US’s rare earth elements. These elements are used in everything ranging from iPhones, semiconductors to EVs, defense drones and magnets. Any trade war tension revolving around rare earth elements will hit tech and semiconductors the hardest, which is where we saw the largest pullbacks on Friday.

To add to this, the Crypto market saw over $19 billion liquidated. This makes the sell off larger than the pullbacks from Luna, COVID, and the collapse of FTX. The amount of liquidations show me that there was a lot more leverage being utilized than people realize. If anything, the takeaway from all this is that unrealized profits are never yours. Always make sure to take profit on the way up and don’t take on more risk than you’re willing to accept.

What to Watch Now?

We need to be cautious and see how China reacts to the US’s tariff increase. The other thing to watch out for is if Trump completely backtracks all threats of increasing trade tensions. Any smoothing over will likely lead to a large V shaped recovery in the stock market, but anything less definitive will create a choppier environment.

On Friday, Trump had also alluded that he would no longer be attending meetings with Chinese officials. Later that night, he backtracked and said that it was not cancelled. During the weekend, President Trump has posted about not worrying about China and that we are wanting “to help China, not hurt it.”

The crypto markets have already rebounded quite a bit with Bitcoin up ~3.5% and Ethereum up over 10%.

On The Bright Side

VIX +30% Spike

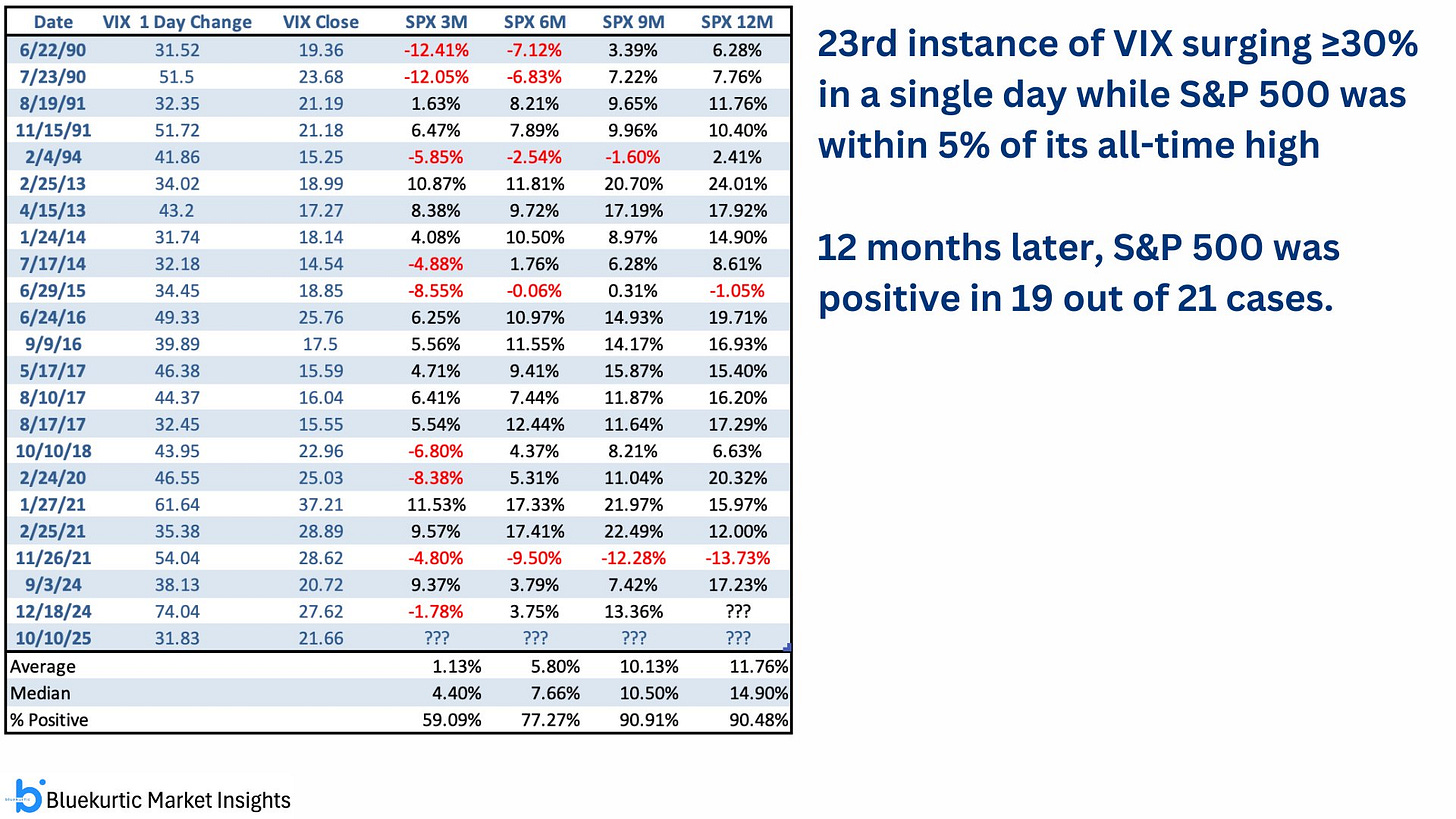

The VIX, volatility index, is commonly known as the fear gauge and spikes when there is uncertainty in the world. This is usually inversely correlated with the market, which is why we saw a 31% spike on Friday as the rest of the market pulled back.

For the past 25 years, a spike on the VIX over 30% results in a rally in the S&P 500 within two trading days 98% of the time.

On average, the next three month outlook after a VIX spike event is still positive. Signs are still pointing towards a relatively strong Q4 to close off 2025 strong. Of course, this can all be negated via worsening macro tension.

Keep reading with a 7-day free trial

Subscribe to The Dividend Journal by ArtisanWill to keep reading this post and get 7 days of free access to the full post archives.